How tasty is the secret of Zomato? [How Does It Make Money! (HDIMM)]

The ingredient list to a 38x subscribed

Dont wanna read 20000 words? Check the summary below

Investors are keen to invest in a loss-making venture like Zomato because of 2 things – its unique business model (Scalable, requires network effects, and soft industry entry barriers) and the potential growth (by my calculations came out to be as high as 38% CAGR)

Zomato has a well-diversified pool of businesses. These include - Listing/Advertising, Food Delivery, Subscription Programs, Live Events, White label Access, Zomato Kitchen. Zomato does this by monetizing its restaurants and its consumers

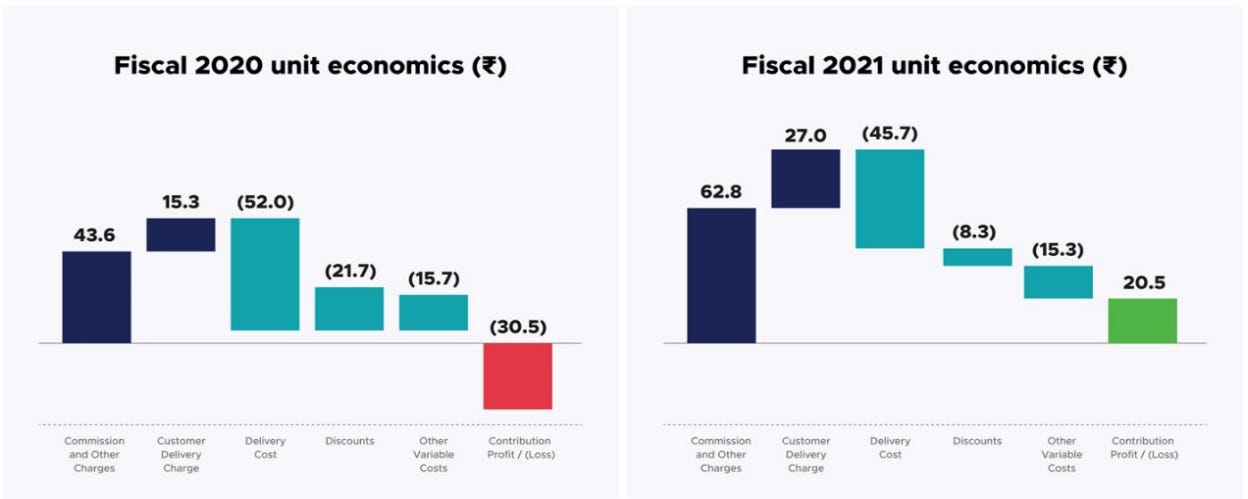

The unit economics of Zomato are healthy. It has a contribution margin of 6.54% of GOV, a Customer Lifetime Value of INR 9122.23 and Cost of Acquiring Customers of INR 4560.95. These are under the assumptions of a 24% Take Rate and a 10% Annual churn Rate.

Zomato has remained on top of every newspaper headline, every mobile phone’s notification panel and every entrepreneur's mind for the past 3 months. Zomato has been that friend who keeps sending us jokes, just in the form of push notifications. Here are some facts about Zomato sprinkled Salt BAE style –

Orders increasing by 13.2 times from 30.6 mm in Fiscal 2018 to 403.1 mm (FY20)

GOV growing 8.4 times from ₹13,341.4 mm in Fiscal 2018 to ₹112,209.0 mm in (FY20)

On an average, 10.7 mm customers ordered food every month on Zomato (FY20)

An average monthly ordering frequency of over three times (FY20)

So, we can certainly say that Zomato has been able to get the attention of people – investors, customers, restaurants, and delivery guys alike. This sparks the simple question of “how does Zomato make money?”

For understanding how it makes money we need to understand 3 aspects of Zomato’s business model –

Why is Zomato doing, what it is doing?

What are the businesses is Zomato in?

Is it really making money or is it losing money? Does it make sense to do business?

Let’s get started then

Why is Zomato doing what it is doing?

To understand, what Zomato is doing an evolutionary perspective helps. So at the cost of being condescending, lets trace Zomato back to its origins.

How did it come here?

Origins - Back in 2008, Deepinder Goyal – then a Bain analyst – found it annoyingly weird to see his colleagues ordering lunch by rummaging through paper menus of local restaurants. He thought of digitizing the menus of restaurants and putting it on an accessible website. Simple enough, right? This was the birth of Foodiebay.com - which in 9 months was Delhi NCR’s largest restaurant directory.

Evolution – Following its meteoric rise in regional popularity, it was bound to come into investors’ attention. By 2010, Foodiebay was rebranded as Zomato. It started branching out into cities like Ahmedabad, Bengaluru, Chennai, Pune and Hyderabad. And by 2012, it started expanding overseas.

All through the decade, Zomato built as solid tech-backbone to enable its operations and growth. This has culminated to the ‘smart’ food-discovery + delivery + booking platform we as consumers see today in Zomato.

Where is it going?

Zomato had an annual revenue of 21,184 MM INR, with net losses of 8,164.28 MM INR, in FY21. Investors have driven the valuation of the company to around ~1079 bn INR.

Why would someone invest in a loss-making company? The rationale behind this lies in the business model of the company –

Asset-light Model enables growth

Inherently Zomato operates on an asset-light model (net Plant Property and Equipment amount to ~1% to 4% of the total assets during the last 3 years). This model is highly conducive for speedy scale-up. And hence the growth potential is a significant attractor for investors to the foodtech platform.

Problems of staging a 3-sided platform in the Indian context

For restaurants to have any interest in the platform, Zomato needs customers. For delivery partners to have any interest in the platform, Zomato needs more orders to justify their time and fuel expenses.

Hence the key driver for achieving network effects (source), is the consumer side of the platform. Thus, Zomato incentivizes the consumer side of the platform, in the form of heavy discounting, excellent customer service and a large offering (enabled through the restaurants).

Changing Industry Outlook – What might Zomato’s take be in it?

Over the next decade, India might witness a shift in their home-cooking consumption patterns. Let’s understand this better with some number, shall we?

The major customer side behavioural shifts are –

increasing the no. of outdoor meals consumption per week and

the proportion they order using food-tech applications.

COVID-19 has made sure that the latter increases significantly. While the lifestyle of the top 10% of Indian population is showing significant changes in home-cooked food habits due to urbanization, and long office hours.

Thus, if the assumptions for consumer and market dynamics hold true, Zomato could potentially be looking at the 535,080 mm INR p.a. revenue. This translates into a staggering 38% CAGR from its FY21 revenue of 21,184 mm INR.

This is just one source of Zomato’s revenue (though it’s most significant source). Zomato through the years has diversified into different offering for its 2-different customer groups. Which brings us to the next key question we have in mind.

What Business is Zomato in?

As we established earlier, Zomato started off as a digital restaurant discovery website. Over the years Zomato has diversified into multiple business giving it multiple streams of revenue. The streams established by Zomato are as follows source (Inc42) –

Listing/Advertising

Food Delivery

Subscription Programs

Live Events

White label Access

Zomato Kitchen

Zomato monetizes 2 participants of its 3-sided platform – Restaurants and Consumers. We can understand the Revenue Model of Zomato by breaking it down on the basis of the source user group.

A look at the revenue model from a platform-sides perspective provides an opportunity for a more nuanced understanding of the operational realities of a three-sided platform model

Restaurant Side Revenue Stream –

Zomato provides a suite of offerings to the Restaurant side, which aren’t noticed much while people are ordering their guilty Wednesday Dinner. The revenue classification is as follows –

Commissions – One of the 2 mainstream revenue sources as a food-aggregator platform is Commission. From the gross total a customer pays includes – Food Charges, Delivery Charges and Surge Charges (Restaurant + Delivery). Zomato pays the restaurants after taking a cut from the restaurants’ revenue

Restaurants Gross Order Revenue (Restaurants’ GOR) = Food Charges + Surge Charge

Zomato’s Share = Restaurants’ GOR * Take-rate

Restaurant’s Share = Restaurants’ GOR * (1 - Take-rate)

Zomato’s Take rate generally ranges between ~ 22% to 24%

Advertisements – The second mainstream revenue source Zomato has as an aggregator is Advertising Revenue. Restaurants pay to rent virtual real estate on Zomato’s application. This come in the form of floating banners. This provides restaurants with top of the stack visibility, and a large amount of revenues for Zomato. Advertisements are done on the basis of subscription contracts factoring either clicks, impressions or a specified time period.

Zomato’s Advertising Revenue = # of Subscribing restaurants * Average Contract Period * Average Contract Value/Period

Consulting – Among other things, Zomato is able to access a goldmine of restaurant and consumer behaviour data. This enables Zomato to draw insights on demand levels, CTA, Ad-tactics, region specific nuances and the restaurant competitive landscape of any region. Zomato leverages this position by providing Consulting Services to its restaurants.

This bucket also includes Zomato’s analytical tool called ‘Zomato Order’. This tool is used by the restaurants to get actionable insights into consumer’s interests and use it for flashing discount offers on food.

Zomato Kitchen – Through this channel Zomato provides infrastructure services for creating cloud kitchens or ghost kitchens. It ties up with entrepreneurs under different labels. The entrepreneur brings in the funds, while Zomato provides the infrastructural and location selection expertise, to better position the venture.

Consumer Side Revenue Stream

Consumer-side is the driver of restaurant-side revenue streams. But the consumer-side hasn’t provided the substantial share of overall revenue.

Live Events – Zomato partnered up with various restaurants to organize live events and carnivals. These carnivals have various attractions like musical performances. Zomato keeps the entire entry fee basket to itself, for these events

Zomato PRO – Zomato Pro and the newly launched Zomato Pro Plus are subscription based serviced provided by Zomato to consumers to avails special discounts, offers and reduced surge, distance fees.

Understanding Zomato’s Revenue Model is a part of the picture. But to understand the business model of Zomato in a holistic manner it is essential to get a sense of what the unit economics for the Zomato looks like. That’s exactly what we’re going to discuss next.

Zomato Unit Economics – Does it even make sense to do Business?

The unit economics were mentioned earlier for understanding where Zomato was going. But here we’d like to answer the fundamental question – Is it making any money at all?

Zomato being an inherently customer driven company focusses a lot on the acquisition, retention and monetization of its customers. For companies like Zomato the unit to be considered should be the customer. This would provide a nuanced understanding of the play Zomato is in.

With that understanding, at a unit level Zomato needs to perform on the following fronts –

Acquire Customer. [Cost of Acquisition or ‘CAC’]

Increase the transaction volume

Extract an Order Value per transaction. Optimistically an increasing order value with time

Retain Customer [Retention CAC]

Extract margin

So! Let’s put the econ/biz caps on.

To understand if Zomato is truly making money at unit customer level, the ratio of Cost of Acquiring a Customer CAC and Customer’s Lifetime Value CLTV should be positive and <1. The CAC/LTV ratio provides an understanding of how valuable the customer is in comparison to its cost of acquisition.

The ratio in case of Zomato came out to be 0.75.

While analysing Zomato I came to understand that the Customer will provide 33% more value throughout its lifetime to the platform compared to their acquisition cost (inverse of the CAC/LTV ratio of 0.75). And this is in terms of the economic value they bring - i.e value they bring through transacting on the platform. This doesn’t account for the network effects related value derived from more users on the platform.

The implications of the network effects related value will affect 3 variables in the above calculations. Through network every extra consumer acquired by the platform –

# of Monthly Transacting User could be increase

Take Rate could be increased

Yearly Churn will reduce

The implication for this is even higher Customer Lifetime Value and lower CAC/LTV ratio. The above has some underlying assumptions about Zomato’s customer acquisition strategy, platform scaling mechanics and supply-side dynamic (Restaurant-side and Delivery Partner-side). But for the sake of simplicity, lets assume that these wont changes much.

The above calculations include 2 important assumptions – Take Rate (Commission Rate) and Churn Rate (Number of consumers leaving the platform). These details were not available in the 420-page IPO Prospectus. So certain, other sources like Zomato’s blogs, Inc42 article and a few podcasts with the founders were used to draw a guesstimate around, the probable actual figures.

The sensitivity analysis on both, these rates, provide us a hurdle rate of 17.46% for Take Rate to turn a positive a Contribution Margin. Post which the hurdle rate of 7.77% for Churn Rate at a 20% Take Rate. This means the Take Rate should be above 17.46% for a contribution positive operation and net Churn should be below 7.77% to reach a CAC/LTV value of less than one.

Upon this we can conclude that, the unit economics of Zomato at the current level are healthy. With increasing popularity of the application these are only bound to improve.

Too Long, Didn’t Read? Go back to the top and check the summary :D

Want to read more about Zomato?

Zomato DRHP - https://www.bseindia.com/downloads/ipo/Zomato_RHP_070720212008.pdf

Pinanity (Medium) - https://haphazardlinkages.medium.com/deep-dive-into-zomato-ca01bcaacade

Inc42 - https://inc42.com/features/what-is-zomatos-business-model/

Startup Talky - https://startuptalky.com/business-revenue-model-zomato/

Have questions? Need clarifications? Let me know if you’d like a detailed calculative understanding for this segment in the comments.

Very well explained! Thank you.

Just wowww! Looking forward to reading more of your work..